Town of St. Johnsbury 802-748-3926

Pomerleau Building, 51 Depot Square, Suite 3

Tax Increment Financing FAQS

Tax Increment Financing

Tax Increment Financing

TIF Documents & Forms

Tax Increment Financing (TIF) Q&A

Tax Increment Financing in Vermont

March 22, 2017

FREQUENTLY ASKED QUESTIONS

What is Tax Increment Financing (TIF)?

TIF is a means to foster economic development without spending existing tax dollars, without raising tax rates and without establishing any new taxes. TIF uses new tax revenue derived from new development or redevelopment. This new “incremental” tax revenue is used for public improvements that make it more feasible for private development projects that otherwise would not occur or would occur in a less desirable manner.

What problems does TIF address?

It is extraordinarily difficult to do economically feasible development in many Vermont downtowns. Costs to build are nearly as high as in Chittenden County but rental rates and sales prices are much lower. In most cases, projects cannot pay their costs, let alone provide a reasonable profit to make it attractive to investors. Consequently, private development rarely happens in many Vermont downtowns without some form of public/private partnership to fill the financial gaps.

Much of the public infrastructure in downtowns throughout Vermont is old and inadequate to meet current needs. Each downtown is different, but many have problems, especially with brownfields and parking, and sometimes other infrastructure such as streetscape, water or sewer services, or stormwater treatment. These pose barriers for private investment. When it’s challenging for a private investment to cover its own costs, it’s not realistic to ask the private sector to pay these costs too. So, the public has a role in addressing the problems that plague our downtowns, to help make them more attractive and more feasible for private development. That’s where TIF comes in.

How does TIF work?

When establishing a TIF, a municipality defines a specific area to be a TIF district. This is an area with opportunities for new development or redevelopment and where new public infrastructure is needed to make it more feasible for private investment. Usually TIF districts are in a Designated Downtown or Growth Center.

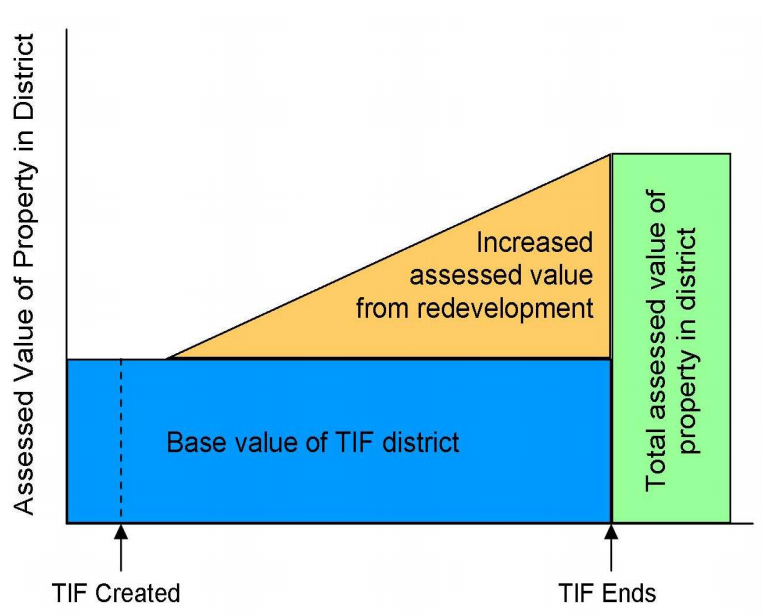

At the creation of a TIF district, the total current assessed value of property in the district is calculated and fixed; this is referred to as the Original Taxable Value (OTV). All property taxes generated by the OTV continue to go to the municipal general fund and the State education fund. No tax revenues based on assessed value pre-dating the creation of the TIF district are diverted from current uses.

The municipality has a period (usually ten years) to make public infrastructure improvements. As new development and redevelopment is stimulated by the public investment, those projects increase the total property value in the district. The increased property tax revenues generated by the new investment is the "tax increment." Seventy-five percent (75%) of both the municipal and education property tax increments are available to service the debt which paid for the public infrastructure improvements. Twenty-five percent (25%) of the respective new taxes go to the municipal general fund and the State education fund.

When the district ends, 100% of the property taxes go to the municipal general fund and State education fund, but now there is a significantly higher total property value, as depicted in the chart above.

What can TIF funds be used for?

TIF funds may be used for public infrastructure and brownfield remediation. The TIF statute says TIF funds may be used for: “…the installation, new construction, or reconstruction of infrastructure that will serve a public purpose and fulfill the purpose of tax increment financing districts as stated in section 1893 of this subchapter, including utilities, transportation, public facilities and amenities, land and property acquisition and demolition, and site preparation”, and brownfield remediation.

TIF funds may not be directly invested in private development projects.

What’s the impact on the education fund?

TIF adds to the education fund. The new tax-paying projects that generate the new incremental taxes would not have occurred or would have occurred in a less desirable manner, but for TIF. The tax dollars being used to pay the TIF debt is money that would not otherwise have existed. And 25% of the new incremental education taxes add to the education fund throughout the life of the TIF district.

At the end of the life of the TIF district, the education fund will be boosted by then receiving 100% of the incremental education property taxes generated by the new development fostered in the TIF district.

Aren't there some TIF districts that have failed?

In Vermont, no TIF districts have failed. There were some early stumbles as we learned how to use TIF effectively, but all districts are now performing well financially and producing results for their communities. One TIF district (Colchester) closed without ever borrowing any money or undertaking any projects. This was not a failure, it was a prudent exercise of judgement when circumstances changed and it became clear the district would not perform as originally planned. Other TIF districts in Vermont have not done as much as originally planned, but all have sufficient incremental revenue to pay current debt service.

I’ve heard that an informal consortium of communities in Vermont is interested in TIF. Who are they and why are they pursuing TIF?

The ad-hoc consortium includes: Bennington, Montpelier, Newport, Rutland, St. Johnsbury, Springfield, and the Brattleboro Development Credit Corporation representing their region of the state.

As for why, communities outside the greater Chittenden County area are experiencing declining population and stagnant downtowns. They want to attract new investment into their downtowns. TIF can be a powerful tool in a municipality’s economic development toolbox to help close the financial gap.

TIF is intended to enhance the attractiveness of these communities’ downtowns to potential developers, businesses, tourists, and residents. This, in turn, provides jobs and improves the local economy.

Current state statutes have a cap on the allowed number of TIF districts. The cap has been reached and no more are currently allowed. The consortium is asking the legislature to remove the cap so that more of Vermont’s hard-hit downtowns have the opportunity to use this powerful tool.

Are there examples of VT municipalities that have effectively used TIF?

There are several, including Barre, the Burlington Waterfront, White River Junction and others. To pick but one example, the TIF district in downtown St. Albans illustrates the benefits. It has been about four years since St. Albans first incurred debt for its downtown TIF district. During that time, they used TIF to:

- Cleanup brownfields on multiple sites

- Build a 370-space parking garage

- Dramatically improve the streetscape throughout downtown

These public investments have directly and indirectly resulted in:

- New 16,700 square foot Ace Hardware store

- New 46,000 square foot office building leased to the State

- New 84 room Hampton Inn hotel (currently under construction)

- Renovations to various existing downtown buildings

- Higher occupancy of storefronts in downtown

- In only four years, the grand list within the TIF district is up over 40%.

None of this would have happened without TIF.