Town of St. Johnsbury 802-748-3926

Pomerleau Building, 51 Depot Square, Suite 3

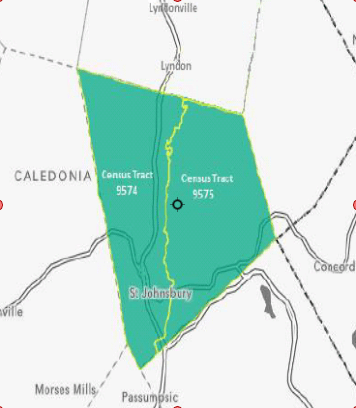

Opportunity Zone

Opportunity Zone

The Tax Cuts and Jobs Act of 2017 created a new class of private investment vehicles called Opportunity Funds to encourage capital investments in projects located in economically disadvantaged census tracts.

These funds must be invested in the following:

- Projects that are in census tracts designated as Opportunity Zones

- Substantially all (90%) of the fund’s holdings must be invested in a Qualified Opportunity Fund (QOF).

How Do Opportunity Zones Work?

- What are the incentives for investors?

- Temporary Deferral: An investor can defer capital gains taxes until 2026 by rolling their gains directly over into an Opportunity Fund

- Reduction: The deferred capital gains liability is effectively reduced by 10% if the investment in the Opportunity Fund is held for 5 years and another 5% if held for 7 years

- An Exemption: Any capital gains on subsequent investments made through an Opportunity Fund accrue tax-free as long as the investor stays invested in the fund for at least 10 years.

- What are the major components?

- Investments: Opportunity Funds make equity investments in businesses and business property in Opportunity Zones.

- Funds: Opportunity funds are investment vehicles organized as corporations or partnerships for the specific purpose of investing in qualified Opportunity Zones

- Zones: States and territories designated 25 percent of their eligible low-income census tracts as Opportunity Zones.

Investing in an Opportunity Zone

- Who can invest?

Investors can be anyone who:

- has capital gains and

- has filed form 8949 with the IRS to set up an Opportunity Fund and

- complies with the deployment timing rules

- What can they invest?

(1) Qualified Opportunity Zone Operating Businesses which must have at least 50% of :

- Employees

- Sales

- Property in Opportunity Zones

(2) Qualified Opportunity Zone Property which must have been

- sold or leased after December 2017

- and be located within the zone.

Public Service

Police Department Fire DepartmentMunicipal Offices

Town Manager Town Clerk & Treasurer Selectboard Assessor's Office Planning and ZoningSt J Rec Department Facebook Page

Visit Us on FacebookFor more information about Opportunity Zones please contact The Town of St. Johnsbury Economic Development Office at (802) 748-3926

ext. 5 or jkasprzak@stjvt.com